If you have read my columns, you know that the issue affecting our country is not a lack of revenue, it is excessive government spending, that has taken a substantial shift upward in the past four years. We have a Federal Government that does not budget, so We the People have no visibility into planned expenditures. We have an administration that is only focused on ideology and not interested in solving our fiscal problems.

In my attempt to continue to educate all on the disaster that is Federal Spending, here is another graphic clearly showing the issue. As you will note, despite what the Administration claims, facts are a stubborn thing. As Mitt Romney told the President - "While you are entitled to your own opinion, Mr. President, you are not entitled to your own facts.

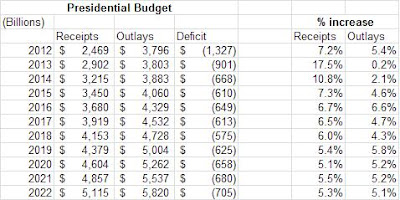

Using data from the Office of Management and Budget, I prepared the chart below that clearly shows that Federal Spending is the real problem.

Take a look at the last four years, clearly there has been a huge jump in expenses relative to other years. While there was a drop in revenue, this is clearly due to the recession, as business and individuals all made significantly less than they had in prior years. But clearly the increase in spending far exceeds the percentage decline in revenues.

In 2009, Federal Revenues were down 17.5%, but Federal Spending increased 46.8%!! Federal Revenue only declined in 2009, since then, revenues have continued to rise, averaging an increase of 3.3% for the last three years.

While one could argue the additional Federal Spending might have been needed to help get us out of the Great Recession, it clearly should have come back down in subsequent years. Clearly that did not happen, and as a matter of fact, the President's own plan shows Federal Spending continuing at the elevated levels and increasing every year for the next 10 years!!

The orange bars show Federal Spending from 2013 to 2022, clearly there is no plan by the President to cut spending, in fact under the President's plan Federal Spending will increase from $3.5 trillion in 2012 to $5.8 trillion in 2022. This equates to an average increase in spending of over 15% per year!!

Revenues are represented by the purple bars and they do show an increasing trend, but that assumes that the economy grows every year at a 5% pace or higher. We are definitely not going to meet that target in 2012 and the plan for 2013 is less than 5% also, so we are already starting out in the hole.

The most disturbing part of this graph is the fact that this Administration plans to run deficit budgets for the next 10 years. Under this plan, the Administration is projecting the we will spend another $6.8 trillion more than we collect in revenues over the next 10 years. This is totally unacceptable and we deserve better. Our children and grandchildren will be the ones to suffer if this becomes reality. We will be the first generation in history to provide a economic reality that is worse for them than we had. We should all be embarrassed by this.

Since the Democrats have failed to approve a budget the last 4 years, it is clear that this is probably the best case scenario and not the most likely.

You can effect the debate. Write your elected officials and tell them to get spending under control!